How to Automate Supply Chain Risk Reports: A Guide for Developers

Do you use Python? If so, this guide will help you automate supply chain risk reports using AI Chat GPT and our News API.

KYC/B (Know Your Customer/Business) and CDD (Customer Due Diligence) are vital for financial and other institutions operating in regulatory-intensive arenas. They act as a shield against financial crime by verifying customer identities and helping organizations understand their activities.

KYC/B and CDD also help manage risk by assessing customer profiles, which enables institutions to tailor services and implement more effective controls. What’s more, KYC/B and CDD procedures build trust with customers, who value their information being protected and financial crime being taken seriously. Ultimately, KYC/B and CDD are essential for financial institutions to operate with integrity, mitigate risk, and ensure long-term stability.

Keeping pace with customer and business information is a constant battle for financial and other institutions obligated to conduct KYC/B and CDD. In the digital landscape, customer details can evolve rapidly owing to frequent social media updates, company acquisitions, leadership changes, and more. This creates multiple challenges for traditional news data sourcing:

Advanced News APIs offer a robust solution to these challenges, enabling institutions to proactively gather comprehensive, real-time data and automate tasks – revolutionizing KYC/B and CDD monitoring for a more efficient and secure financial landscape.

The digital world has introduced a layer of complexity to identity screening for KYB and CDD. Companies can easily create synthetic corporate identities using scattered online data, making it difficult to distinguish legitimate business customers from potential risk actors. What’s more, digital footprints are fragmented across various platforms – making manual verification of company activity and identity a time-consuming and potentially incomplete process. To make matters worse, online information is constantly evolving, meaning that traditional one-time checks easily miss crucial updates on negative news or changes in risk profiles.

To combat these complexities, comprehensive company digital identity checks have become essential during KYB and CDD. Ideally, these checks should go far beyond basic verification and delve into the world of news, public, and corporate records. By incorporating sanctions screening, institutions can identify businesses tied to illegal activities or restricted countries, reducing the risk of engaging with sanctioned entities. News monitoring can also be used to identify PEPs (Politically Exposed Persons) and their associates, establishing possible connections between them and corporate customers, which helps institutions avoid potential corruption and reputational risks. Similarly, News APIs can be used to scan for negative news articles or public records that might indicate high-risk business behavior, such as fraud or money laundering. This empowers institutions to identify red flags and take appropriate action.

Monitor Risks with News API Now

Cutting corners with KYC/B and CDD exposes institutions to a multitude of risks:

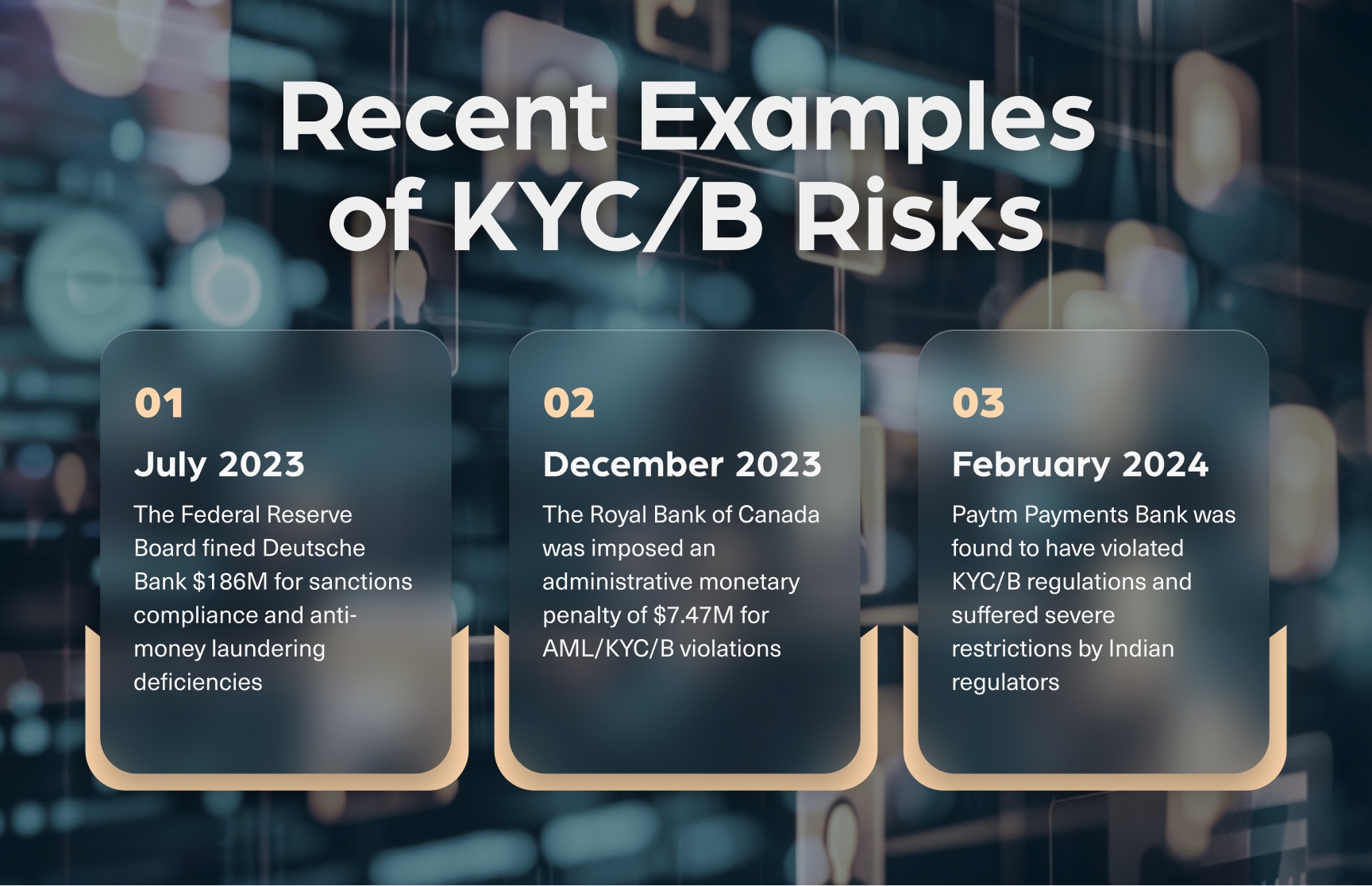

How real is the risk? By way of recent examples:

To avoid the pitfalls of KYC/B and CDD, financial institutions and other organizations

need to ensure they get the right data in the right context at the right time. They need a 360-degree view of all aspects of KYC/B and CDD – lowering the false positives that slow processes, dramatically lowering the risk of non-compliance, lowering the risk of supply chain requirements, and identifying and managing money laundering and terrorist financing risks more effectively and quickly.

A News API can facilitate this. Webz.io’s News API offers:

Additionally, Webz.io offers a wide range of supplemental intelligence feeds – including a Blogs API that offers blog content from around the world in multiple languages, a Forums API with structured data from forums, discussions, and message boards, and a Dark Web API that crawls millions of sites, forums, and marketplaces in the dark web.

Talk to one of our data experts today to see how News API can deliver real-time, reliable data to mitigate KYC/B and CDD risk for your organization.

Do you use Python? If so, this guide will help you automate supply chain risk reports using AI Chat GPT and our News API.

Use this guide to learn how to easily automate supply chain risk reports with Chat GPT and news data.

A quick guide for developers to automate mergers and acquisitions reports with Python and AI. Learn to fetch data, analyze content, and generate reports automatically.