KYC/B (Know Your Customer/Business), CDD (Customer Due Diligence), and similar regulatory-facing solutions were born in the financial services sector. But today, they have spread to nearly all industries. These solutions are used by companies of all sizes, in all geographies and markets. With them, companies and organizations can ensure that customers, agents, consultants, and distributors are actually who they say they are – maintaining compliance with Anti Money Laundering (AML) and Countering the Financing of Terror (CFT) regulations.

The demand for effective KYC/B is ubiquitous and urgent. While it’s always been difficult to cross-check customer identities and legal status, the addition of the digital identity layer has compounded the challenges. Customer onboarding and ongoing customer contact is today largely online. And rectifying digital identity with real-world documentation like passports and drivers’ licenses is no longer sufficient. Companies need to dig deep into digital identity to gain comprehensive knowledge of each customer – identifying entities and people who are the subject of sanctions, Politically Exposed Persons (PEP), or who could pose high risk to customers and stakeholders. This online identity challenge is acute: so acute, that even some blockchain platforms – traditionally paragons of digital anonymity – are building in identity verification mechanisms.

The dangers of noncompliance

As demands for better KYC/B grow, so do the risks of noncompliance with KYC/B regulations. Companies found in breach of regulations can be prohibited from selling specific products or services in certain regions. They can suffer serious reputational and brand damage. And once a company has been caught in noncompliance, regulators tend to scrutinize every aspect of company activity – including company digital supply chain and third parties. This means that any regulatory intervention carries a real risk of impeding operations and stunting growth.

What’s more, KYC/B liability no longer stops at the LLC. The personal costs of noncompliance with KYC/B regulations are skyrocketing. Recently, a US court fined two entrepreneurs (not the companies they work for) $30 million for “failing to implement a Customer Information Program (CIP) and Know Your Customer (KYC/B) procedures…”

Despite these dangers, the implementation of effective KYC/B programs remains hobbled. One of the primary stumbling blocks? The availability of accurate, reliable, timely, high-quality, validated and structured customer identity data.

Putting data to work, at scale

Compliance with KYC/B regulatory regimes carries huge liabilities, and the rules of the game are constantly changing. The baseline of voluntary KYC/B disclosures (scanned IDs, questionnaires, etc.) required by FinCen and other regulatory bodies is really only a starting point for risk-averse organizations. Far deeper digging is required.

Yet manual or automated open web searches are neither viable at scale nor reach deep enough.

To be clear – there is no shortage of data available on most individuals and legal entities. The challenge is putting that data to work, at scale. To put data to work at scale, organizations need extensive data coverage and the technology to continuously and automatically discover, classify and analyze existing and new sources of relevant data.

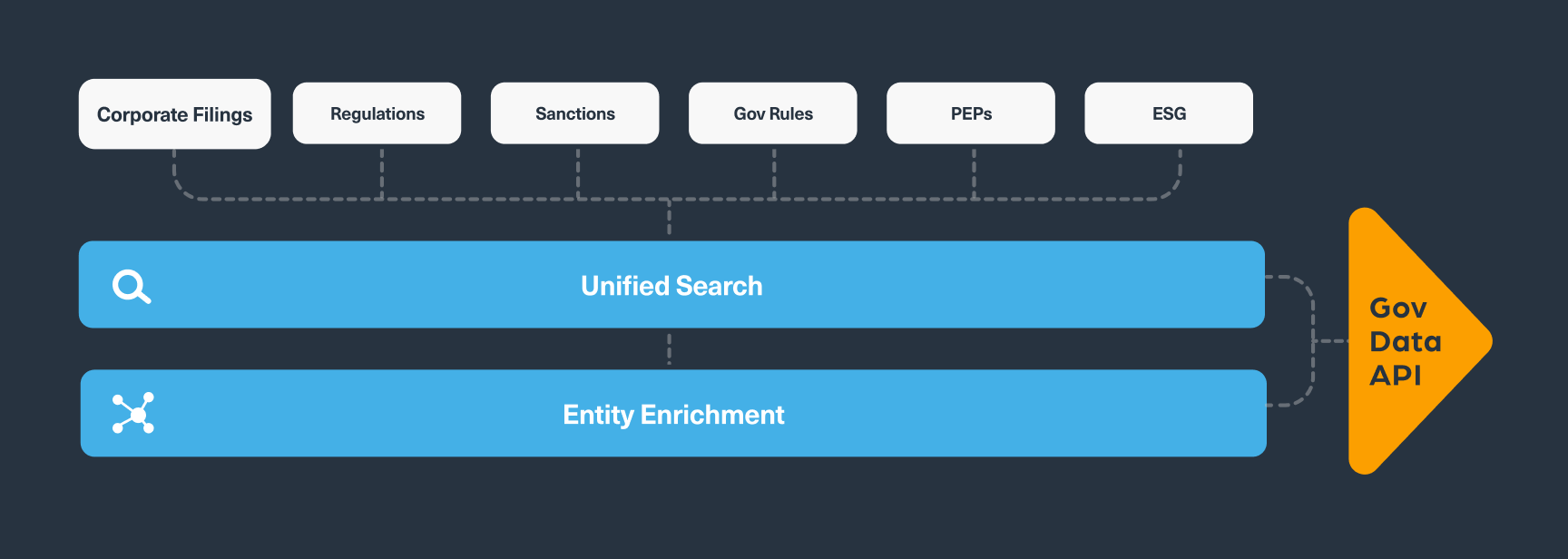

Data coverage needs to be sweeping. Organizations need to constantly monitor, capture and analyze unstructured information from across multiple, diverse and dynamic data sources – both public and hidden. They need to monitor governmental rules, regulations, ESG data, sanction lists, PEP lists, and corporate filings. They need to constantly crawl government sites in multiple languages and multiple jurisdictions, including historical data. They need to scour multiple watchlists and law enforcement databases. And they need to reach deep into the darker corners of the internet to find potential evidence of risk before it becomes a threat to the organization.

What’s more, for every individual or entity examined, enterprises need to automatically derive insights from data gathered. This is an especially tall order, given that the average enterprise-level KYC/B department can be examining literally hundreds of thousands of individuals or entities at any given moment.

A 360-degree view of KYC/B data

Essentially, organizations need a 360-degree view of all aspects of KYC/B data. They need to lower false positives that slow KYC/B processes. They need to dramatically lower risks of noncompliance and of supply chain KYC/B oversights. And they need to more effectively identify money laundering and terrorist financing risks in near real time.

The right web data solution can facilitate this. Our Gov Data API offers access to authoritative and current data from government and regulatory agency sites. Our tech scours public data, data from legal records, corporate records and filings, sanctions and watchlists, and much more. This provides KYC/B stakeholders with the peace of mind of knowing that prospective business partners or customers are actual legal entities, with actual business with an actual address and no surprises, or that an individual is exactly who he/she claims to be.

What’s more, we help our KYC/B customers corroborate data uncovered further by running it against up-to-the-minute news data, to get an even fuller picture of their customers. Want to understand what Webz.io can do for your business and your clients? Talk to one of our experts today.