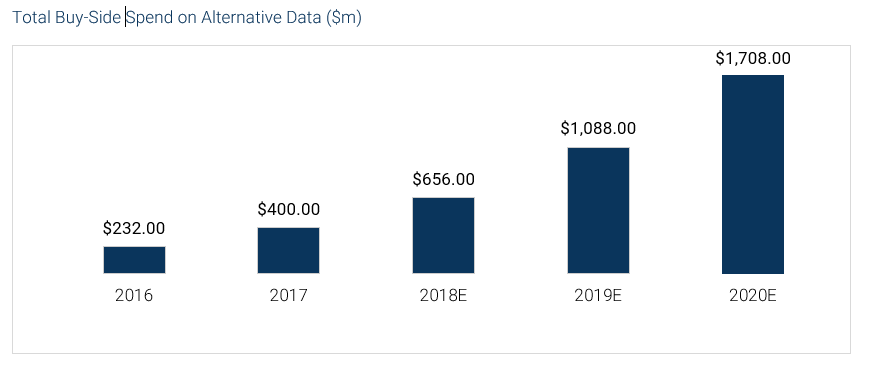

A few years ago the concept of alternative web data hit the qualitative hedge fund market, causing a huge stir. Today the concept of alternative web data has infiltrated all types of investment management institutions on the buy-side, including mutual funds, pension funds, and private-equity firms. As increasing numbers of financial institutions jump on the bandwagon of alternative data, spending on alternative data by buy-side institutions (i.e. mutual funds, hedge funds, pension funds and private-equity institutions) has skyrocketed from $232 million in 2016 to an estimated $1.7 billion in 2020.

With the additional integration of alternative data, and alternative web data in particular, investment management institutions and hedge funds in particular that once relied only on traditional data now have an edge in predicting the rise and fall of the markets.

Why Investment Managers are Leveraging Alternative Web Data

Web data, which includes posts from news articles, blogs, discussions and forums offers advantages over other types of alternative data. The scale and diversity of web data is vast enough to offer highly personalized and relevant datasets for specific industries and use cases. Web monitoring services such as Webz.io that also offer archived data can be particularly valuable in producing such datasets. In addition, web data such as news, blogs and forums are constantly updated and offer companies the ability to continually keep up with their industry.

Due to the above characteristics, alternative web data can be especially valuable for investment managers in its ability to enhance signal. The first in the financial industry to take advantage of this type of alternative data a few years ago as a whole were hedge funds, but it has since gained traction in the remaining buy-side institutions as well. A WBR survey in the third quarter of 2018 found that 79% of investment institutions use alternative data. Of the non-users surveyed, 82% of them plan to incorporate alternative data into their trading strategies within the next year.

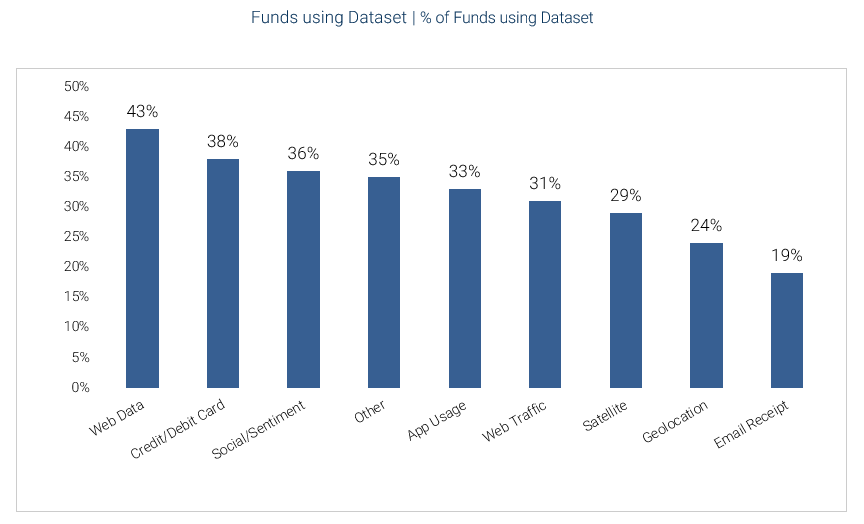

Another recent Greenwich Associates study announced that 72% of investment management institutions reported that alternative data of all types has enhanced their signal. A fifth of respondents reported that alternative data was responsible for them receiving more than 20% of their alpha. And alternative web data is the first type of investment these institutions invest in, right next to credit card data.

Source: Alternativedata.org

Powering the Future of the Financial Industry

What was only a few years ago a question of when institutions should start using data has shifted to the question of how they can organize and structure these mostly unstructured datasets. And with 4 billion webpages and 1.2 million terabytes of data on the internet estimated to be generated globally by 2025, there is no shortage of web data to sort through. As increasing numbers of investment management institutions incorporate alternative web data into their predictive algorithms, it will radically change the face of investment as we know it.

Want to see specific examples of how investment manager institutions are leveraging alternative web data? Download the white paper How Web Data Powers Predictive Analytics in Finance to learn how innovative fintech companies like SESAMm are using leveraging Webz.io’s alternative web data to give investment managers an edge in the market.