There’s a manual data tracking problem when it comes to regulatory compliance, according to our recent survey of respondents from the Risk Management, GRC, RegTech, and Regulatory Intelligence industries.

Today’s businesses understand how essential it is to collect, track and monitor their data to ensure they are on top of critical regulatory requirements, and yet it’s becoming harder than ever before to stay on top of the growing volume of work involved.

With real-world data gleaned from the survey report The Top Challenges of Monitoring Regulatory Risk in 2022, this article will look at the paradigm shift that’s happening right now in the regulatory tracking software market. As businesses increasingly recognize the limitations of their current third-party solutions for tracking regulatory data, they are ready to channel growing budgets into meeting challenges and closing dangerous gaps.

Tracking regulations is essential… But challenging

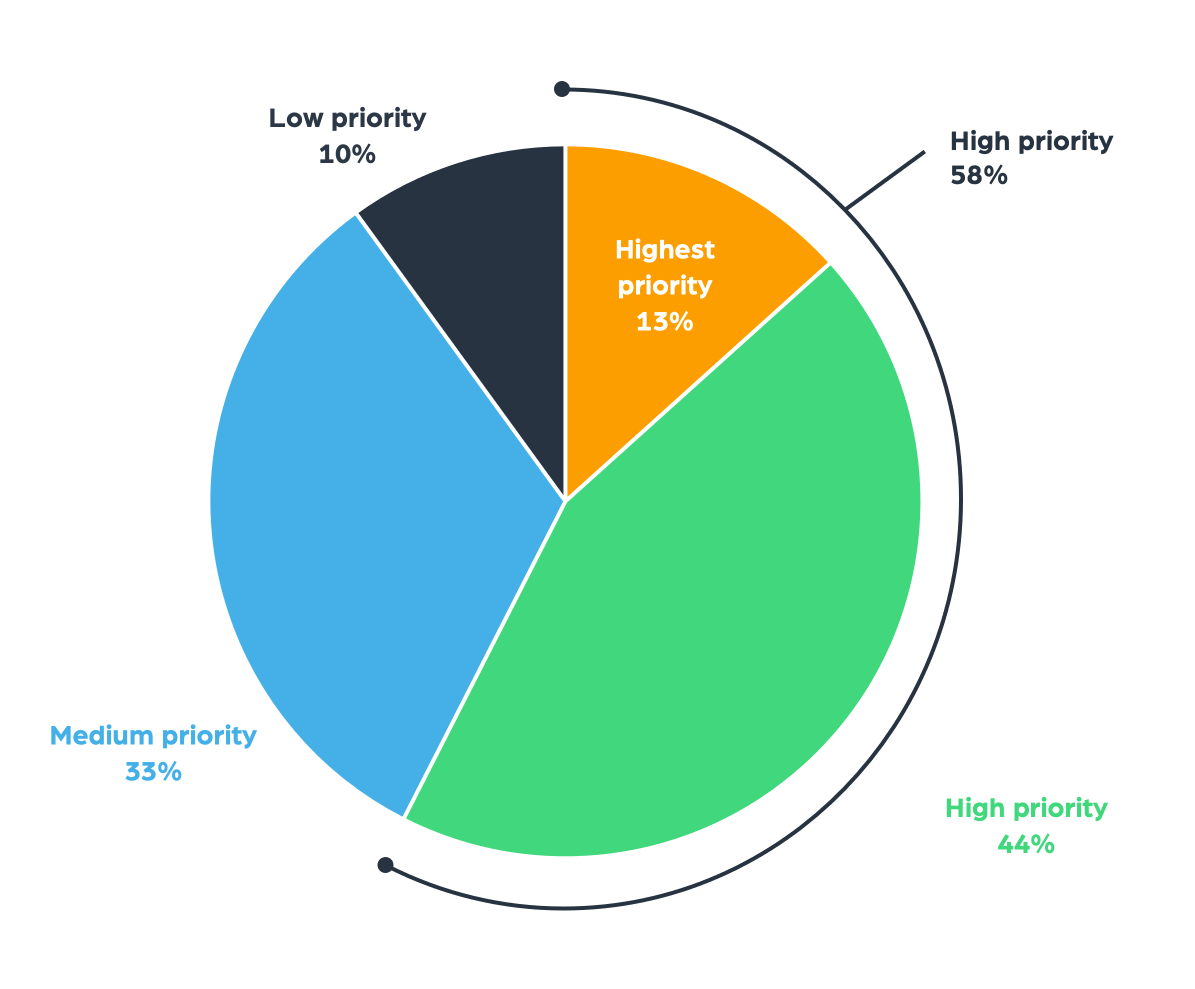

Tracking changing regulations is a massive priority for today’s businesses. In fact, 58% of respondents – VPs, Directors, and C-suite employees who work at companies developing software in Regulatory Risk Management, GRC, RegTech, and Regulatory Intelligence – specifically call tracking changing regulations a high priority, with a further 33% marking this task as medium priority. It’s clear that no one is sticking their heads in the sand. 90% of businesses recognize how important tracking regulatory compliance data is.

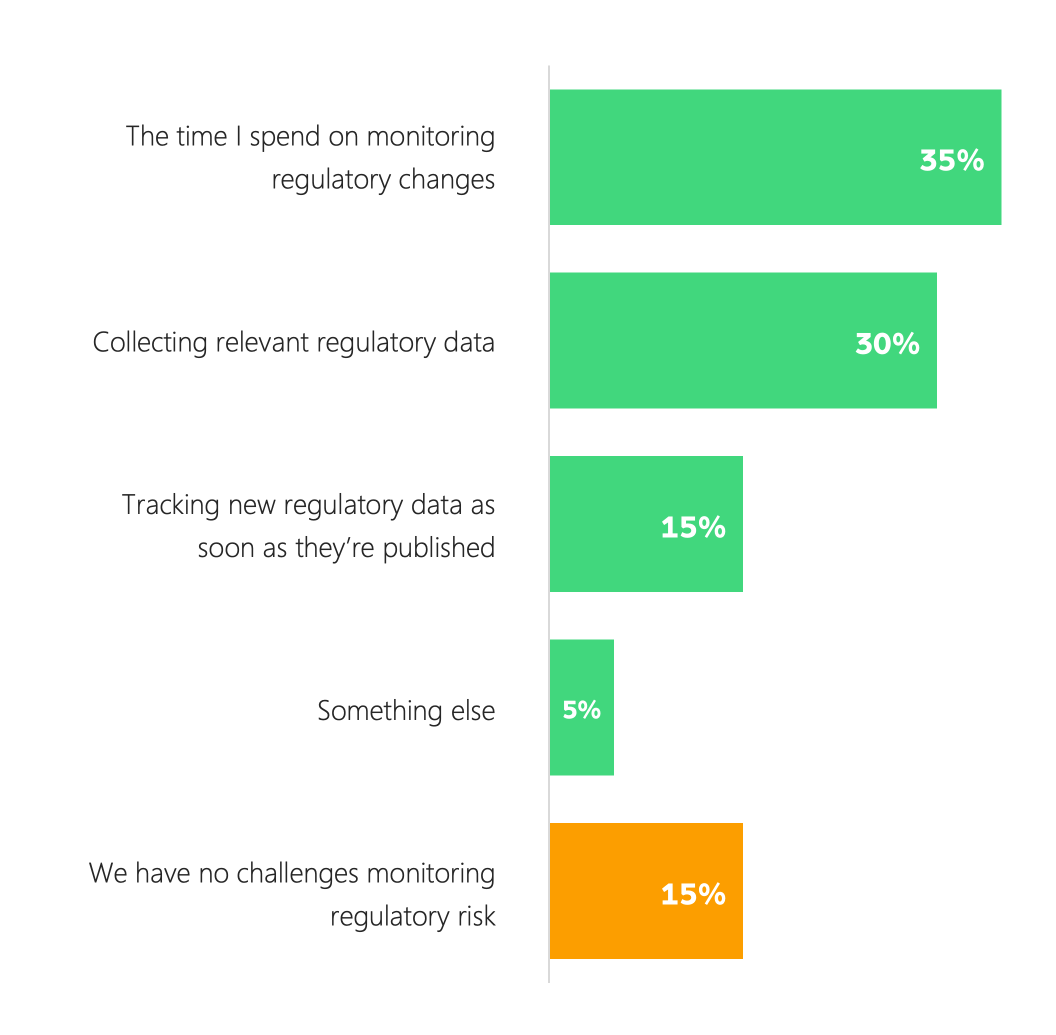

However, according to 85% of companies, monitoring regulatory risk is a challenge. The top issues highlighted are the physical time spent monitoring changes, collecting data that is relevant, and tracking the new regulatory data in a timely fashion. That’s four-fifths of companies who are looking for support with this critical task.

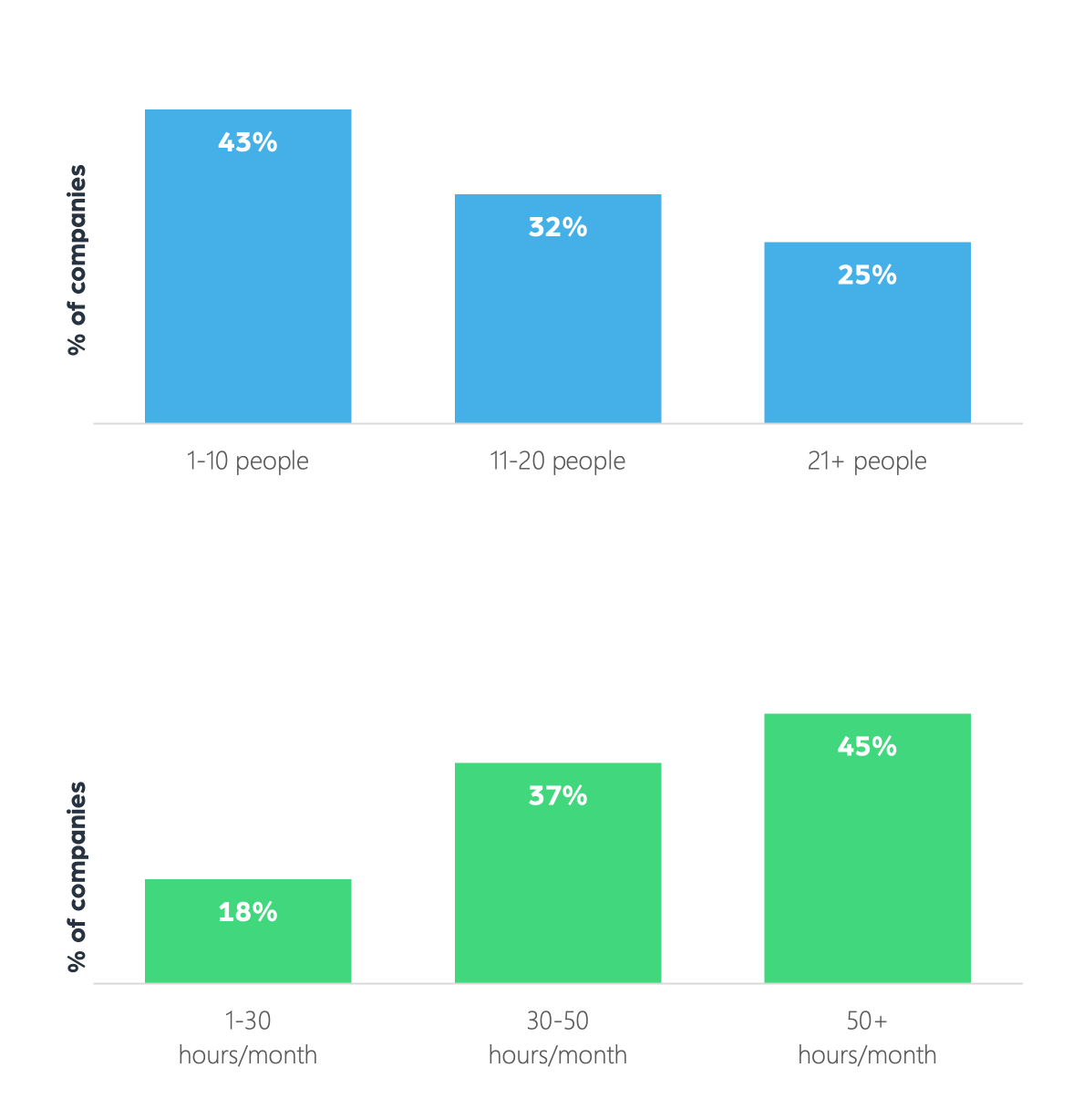

These challenges come through clearly in the data. On average, companies have 13 people working on regulatory data tracking, who are spending 40 hours each month on this work.

In a quarter of cases, the resource investment jumps to more than 21 members of staff who are responsible for this task. Not only that but in almost half of businesses (45%), more than 50 hours per month are allotted to regulatory tracking for compliance purposes. If we consider a 40-hour working week, that’s more than a quarter of an employee’s time is spent on unnecessary manual efforts.

You might be forgiven for thinking that these issues come from a lack of technology. After all, automation seems like the obvious answer – a key enabler of solving these exact challenges. Isn’t that the very promise of RPA and automation? To take slow, repetitive work off the hands of employees, and allow quality data to be accessed and utilized faster? According to Deloitte, speaking specifically about banking and securities, automation can “significantly improve business processes by streamlining activities that are highly labor-intensive and time-consuming.” This allows businesses to “complete thousands of hours of manual regulatory reporting work in just minutes with little or no human involvement.” However, it’s not the lack of technology that’s the problem.

A manual data collection problem… But not for the reasons you may think

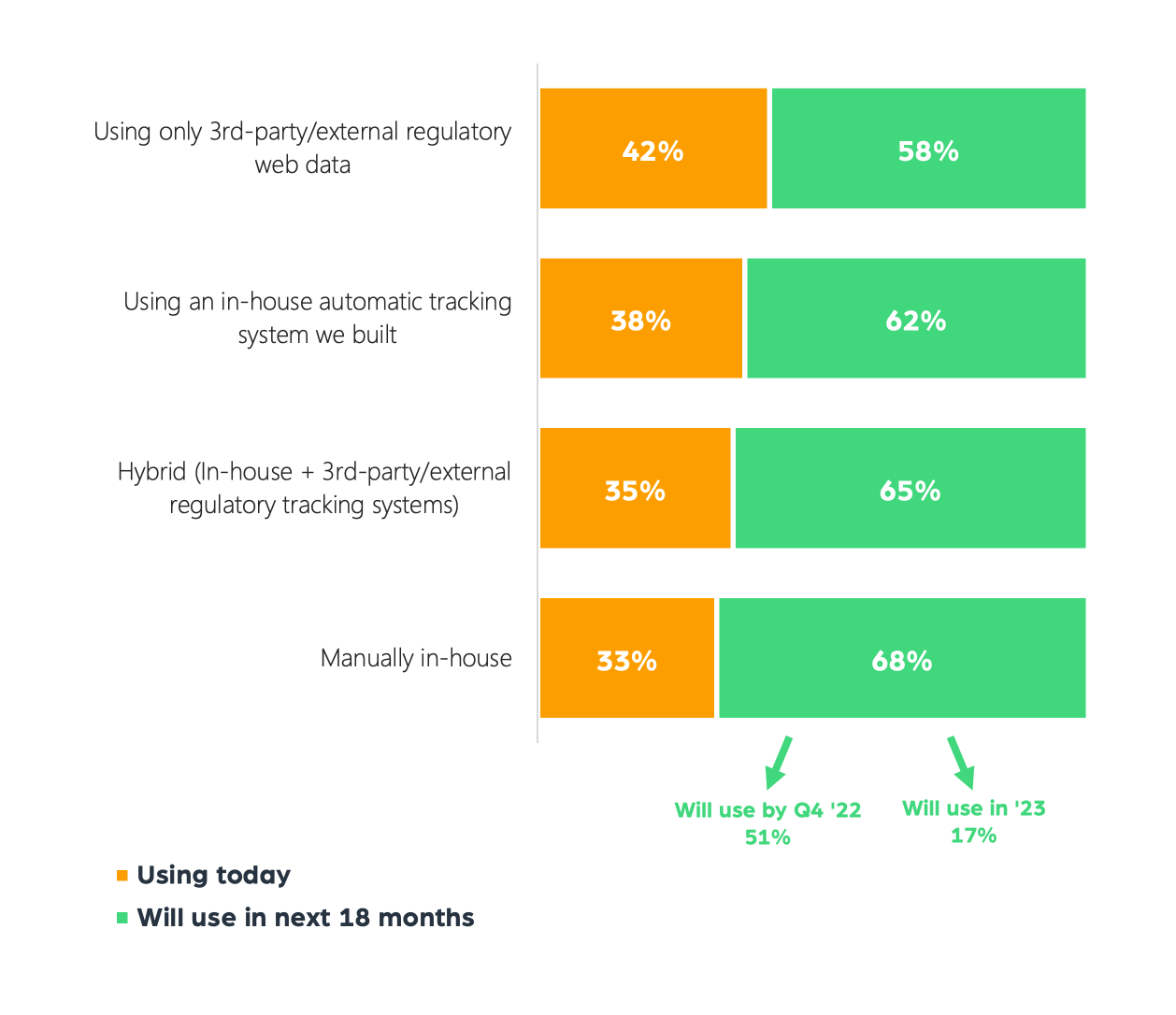

Just 33% of respondents say that they are tracking regulatory data manually in-house, debunking the idea that it’s a lack of automation that’s the issue at hand. The other 66% are using either a tracking technology they have built in-house or relying on third-party software. In 35% of cases, companies are using a hybrid mix of both in-house and third-party technologies.

Yet while the current percentage stands at 33% manual tracking, companies predict they will track more than half of their regulatory data manually by the end of 2022, before this number drops sharply to 17% in 2023.

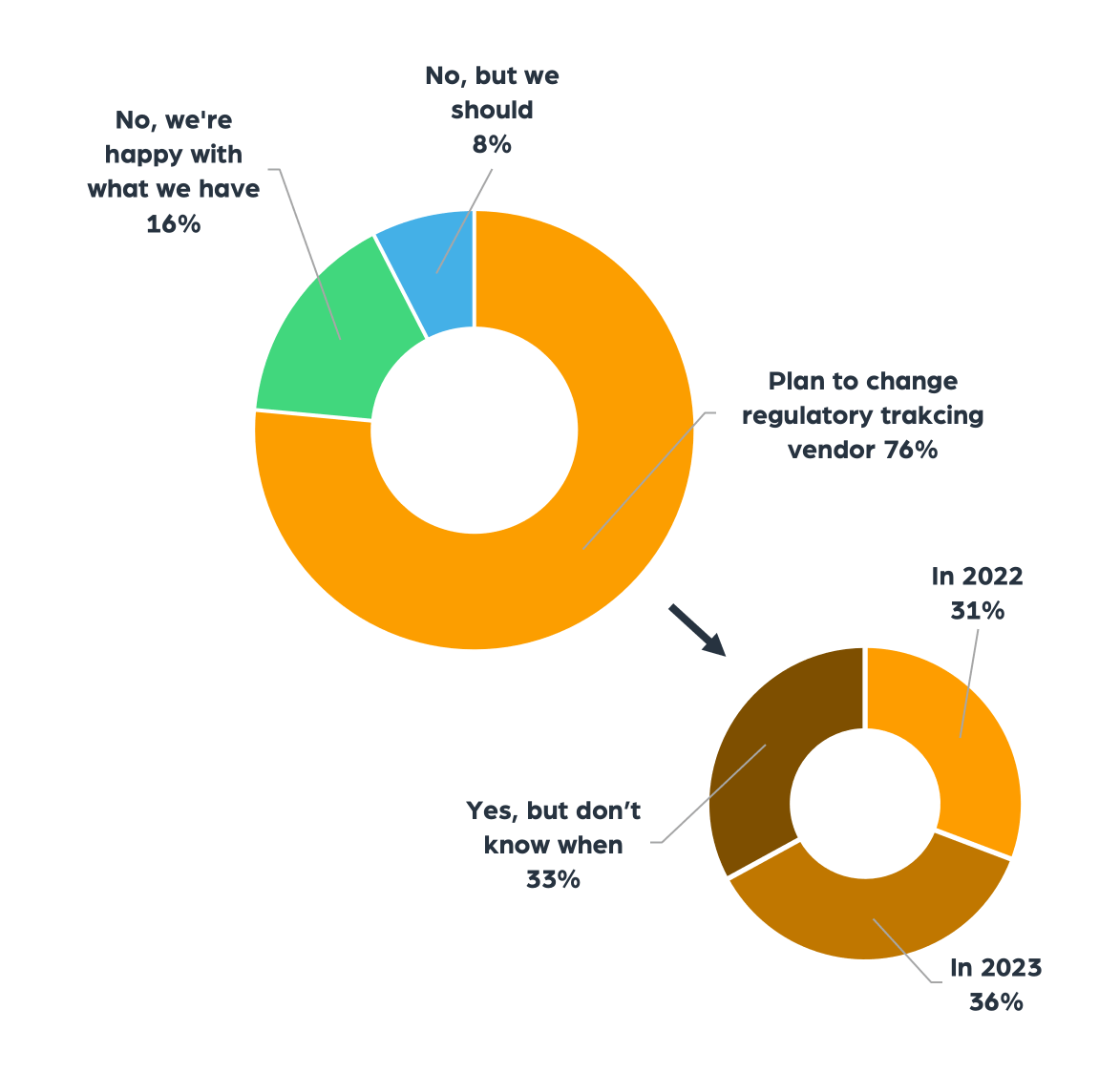

Why has this pattern emerged? And how does it relate to the technology that businesses are utilizing? According to the data, largely speaking, companies are deeply unhappy with their regulatory tracking solution and are ready to make a shift. In fact, just 16% of respondents are happy with their regulatory compliance tracking vendor, and more than three-quarters are so unhappy that they already have plans to move to a new solution.

Clearly, the question isn’t if companies will change vendors for regulatory tracking, but when. Of that 76%, 31% are in the process of switching now, 36% have it on the roadmap for the next 12 months, and 33% would like to move immediately – but aren’t sure exactly how to make it happen. It’s then no wonder that companies expect to have so much more manual data collection and tracking on their hands in the next year, as the vast majority of them will be transitioning to a new solution. Respondents believe that the future is automation, as they expect to transition to a reality where 87% of their tracking is automated by 2023.

Why the urgency?

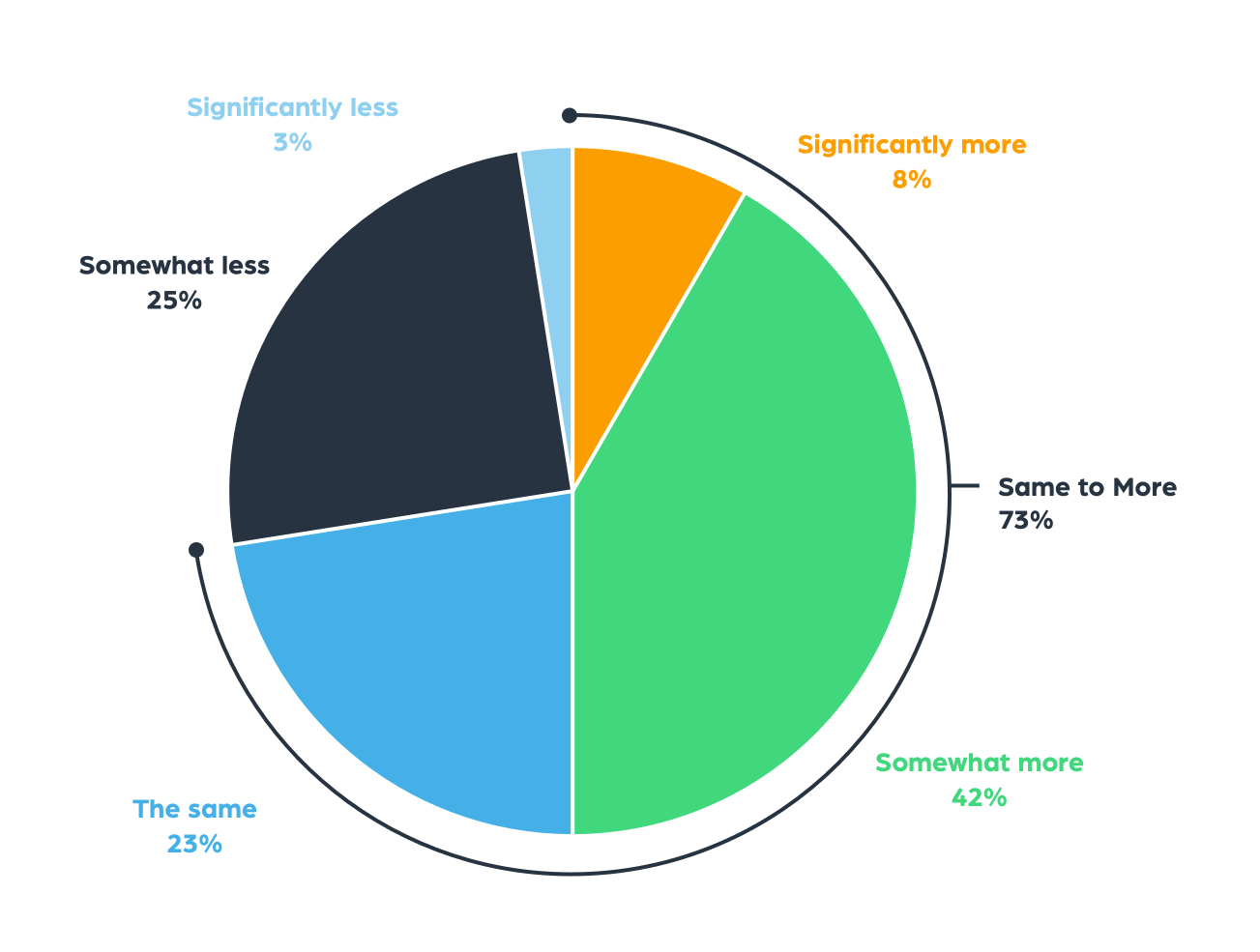

Only 3% of businesses believe that they will be spending significantly less time tracking regulatory risks next year compared to last year. This shows that the challenges that we’re seeing here are a growing problem for regulatory tracking stakeholders.

In fact, 73% believe the amount of time they spend will be the same or more, and 8% say it will be significantly more.

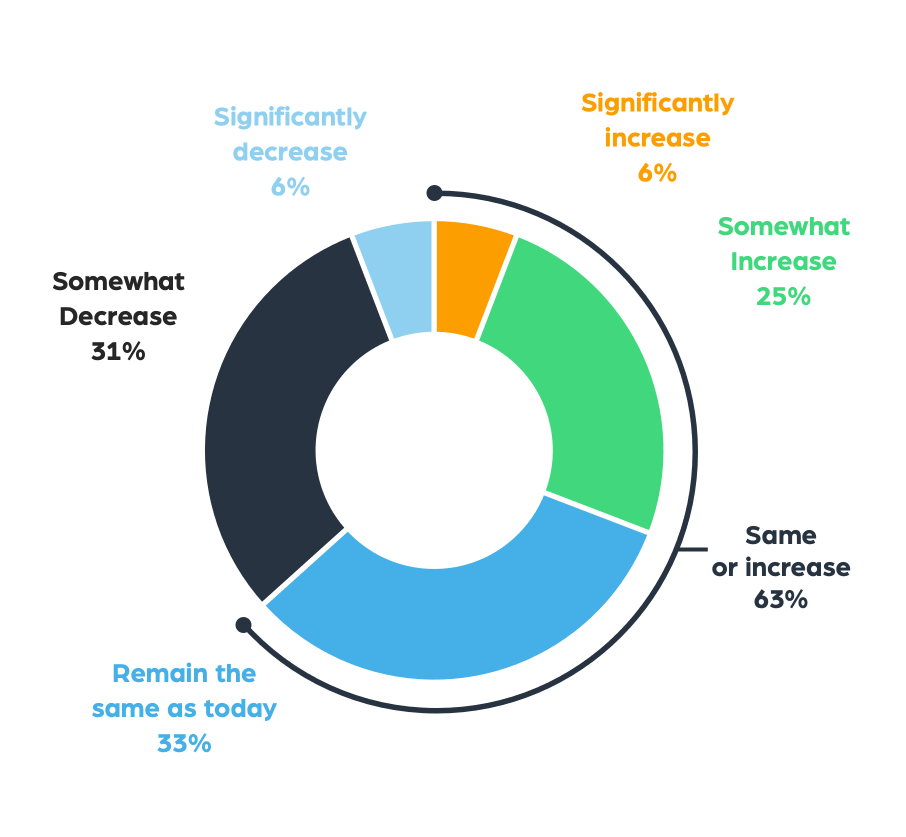

This is directly linked to the volume of data, as regulators continue to publish an increasing amount of information that needs to be tracked, monitored, collected, and actioned. Just 6% expect a significant decrease in the volume of regulatory data, and 63% believe the workload will be the same or more.

If 85% of stakeholders are already feeling the pinch of manual work in this area, they simply can’t afford to wait for things to get worse before they look to move vendors and get the promised benefits of automation.

In-house or third-party… It’s time to decide

As we mentioned before, more than a third of companies currently have a hybrid solution for regulatory tracking. With the vast majority looking to change their solution, the age-old question rises up for today’s decision-makers: Build or Buy?

To understand the best course of action, it’s important to think about why organizations choose to do one or the other in the first place. The usual reasons for building in-house are to retain greater control, and this course of action is best suited to companies who know exactly what they want to create and yet can’t find it from an external provider.

In contrast, relying on a third-party tends to be the right choice when you don’t have the technical skills in-house to build, or you don’t know exactly what you’re looking for in terms of functionality. In this case, you probably want to rely on external expertise who has ‘been there, done that.’

In this situation, the challenges that businesses are facing in integrating regulatory tracking services into their workflows paint a very clear picture of the best course forward.

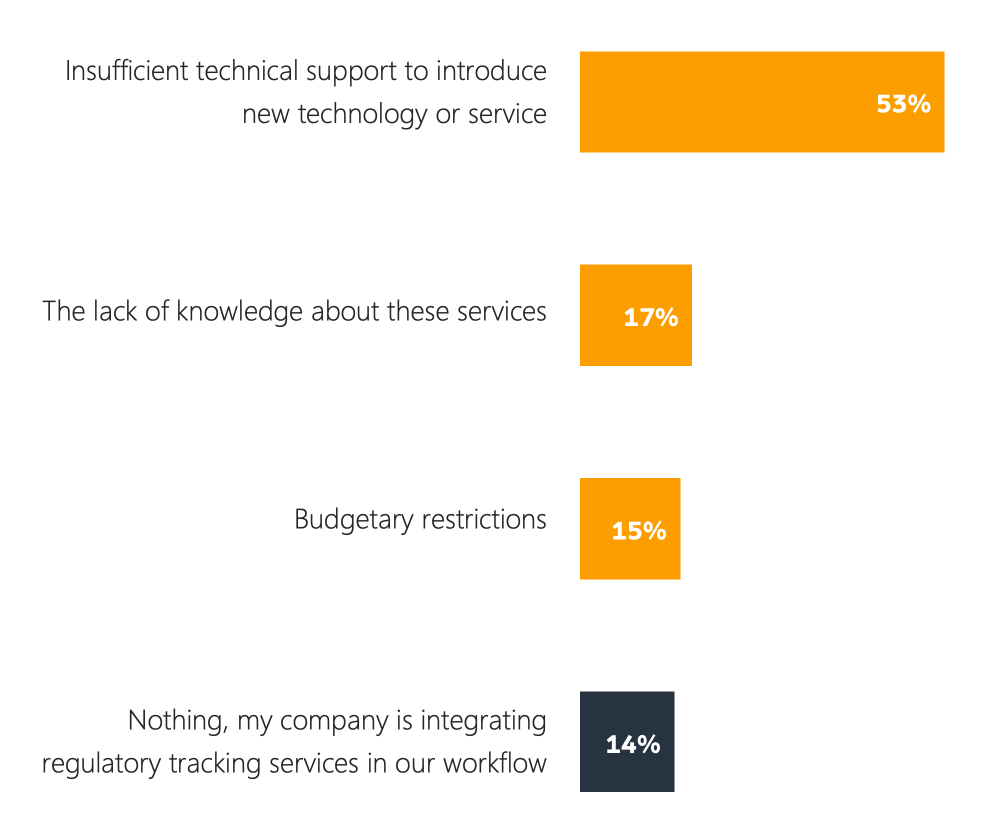

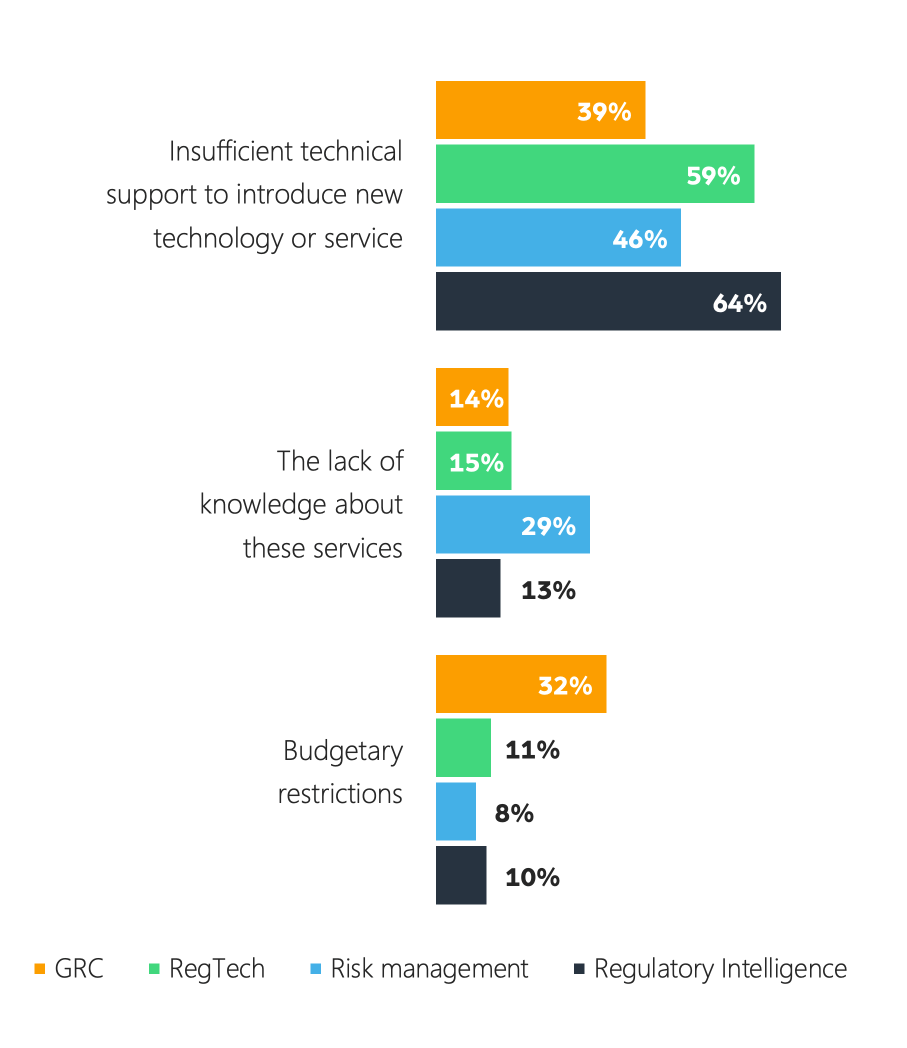

The number one challenge for 53% of businesses is insufficient technical support for technology or services, followed by the lack of knowledge about regulatory tracking services. It’s crystal clear that today’s organizations need to look to third parties to lead the way, especially as their current automation through building in-house is not meeting their existing needs.

But for many businesses, relying on a third party is not enough in and of itself. After all, many have already onboarded third-party solutions, and yet they are still on average wasting those 40 hours per month across 13 employees. This can also be due to the lack of knowledge about these services, a problem that is exacerbated in certain industries, such as Risk Management, as seen in the survey results. In this case, education will be key in order to make sure that businesses make intelligent purchasing decisions that can truly make a difference to the manual efforts currently involved in regulatory tracking.

As budgets grow in this critical area… Smart technology will need to meet challenges head-on

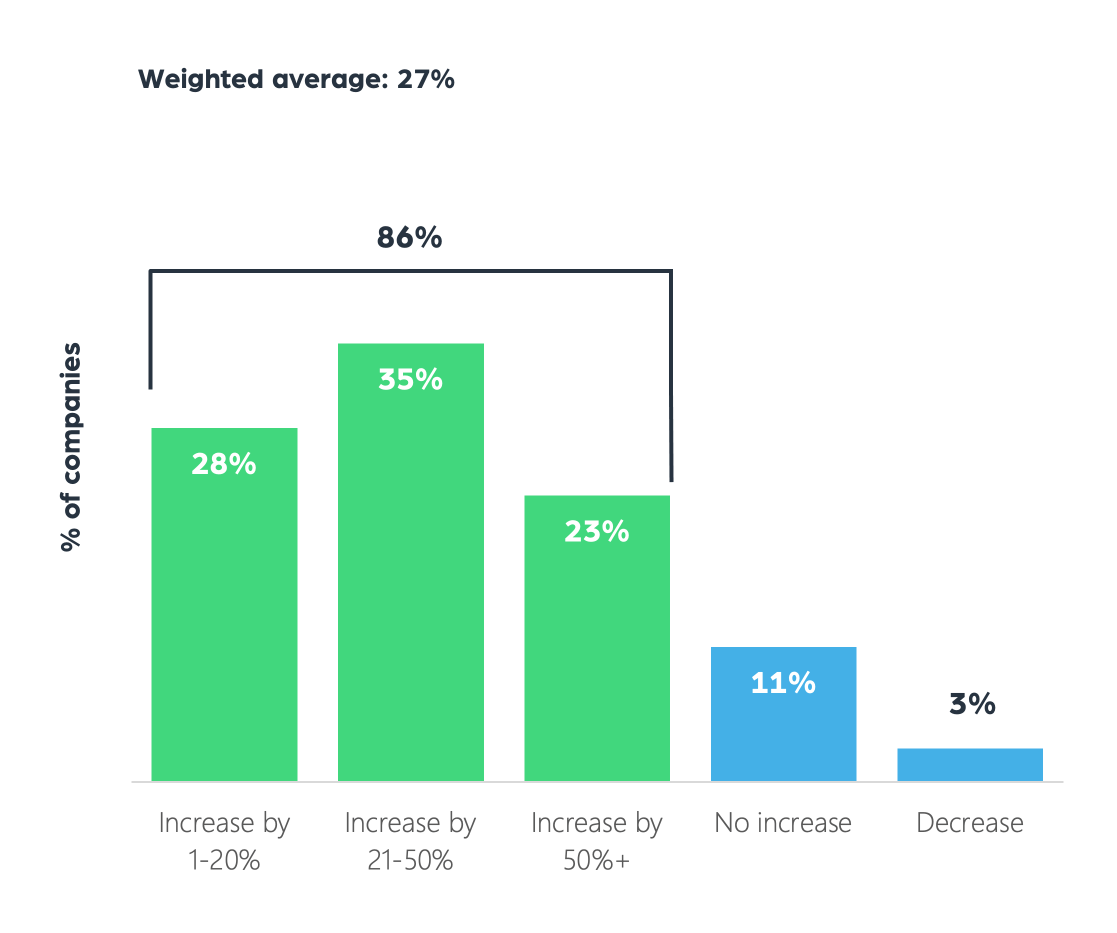

86% have increased their budget for regulatory tracking this year, and almost a quarter raised it by more than 50%. Just 3% of respondents mentioned a decrease in the budget in 2022. Spoiler alert: Money is not the problem.

There’s no doubt that businesses are ready to funnel money into solving the key business challenge of collecting regulatory data without drowning in manual workload. Just 15% called out budgetary restrictions as the reason why they couldn’t integrate regulatory tracking into their workflows right now.

Organizations that are looking for new vendors, that’s 76% of all respondents, are clearly looking for tools and technologies which can make the best use of this budget.

In particular, smart companies will turn to third-parties who can meet their specific challenges in regulatory tracking:

- Reducing the time spent on manual data collection: Auto-discovery that finds and classifies sources of relevant data behind the scenes.

- Collecting data that is relevant to their contextual needs: A breakdown by domain-specific attributes such as category, location, and more.

- Tracking newly published regulatory data in a timely fashion: With a direct feed to international regulatory changes, ESG, government rules, sanctions, and corporate filings.

Want to dive into the data for yourself? You can download the full survey report The Top Challenges of Monitoring Regulatory Risk in 2022, and make sure to reach out to discuss how your business can better automate your regulatory tracking services with the latest, structured regulatory web data.